One of the ways of opening a company in Malaysia is by registering a limited liability company, also known as a company limited by shares, and it represents the most popular business form selected for company formation in Malaysia. It is advisable to register a company limited by shares as the shareholders are liable only with respect to their shares owned in the company. Our team of company formation specialists in Malaysia can offer assistance for the incorporation of a limited company.

| Quick Facts | |

|---|---|

| Who can register an LLC in Malaysia? |

Domestic or international investors |

|

Best use for an LLC in Malaysia |

– import & export, – manufacturing, – logistics, – retail |

|

Number of shareholders |

At least 2 shareholders |

| Minimum share capital |

USD 2 |

| Formalities and documents |

– name verification and reservation, – Articles of Association, – licenses and permits application, – tax registration |

| Local corporate bank account required |

Yes |

| Resident director required (YES/NO) |

Yes |

| Legal representative required (YES/NO) |

Yes |

| Local office required (YES/NO) | Yes |

| Government approval for foreign investors (YES/NO) |

No |

| Time frame for company registration |

Around 4 months |

| Time frame for tax registration |

Around 1 month |

| Possibility of hiring foreign employees |

Yes |

| Investment incentives offered (YES/NO) |

Yes |

| We provide support for business registration (YES/NO) | Yes |

Table of Contents

What are the legal requirements for starting a company limited by shares in Malaysia in 2024?

The Malaysian company limited by shares may take two main forms: the public limited company (Berhad) and the private limited company (Sendirian Berhad). The difference is given by the rights related to the owner; a public company allows the investors to own shares in the company, while for the other type of legal entity, this procedure is prohibited. As a general rule, the private limited company is selected for medium-sized companies, while the public company is employed for larger businesses operating in Malaysia.

The set paid-up capital for LLCs in Malaysia is RM 5,000. Besides that, a foreign entrepreneur interested in this form of business must also pay RM 50 for name verification and approval, and RM 1010 as a government fee.

LLCs established in Malaysia are allowed to raise money by issuing bonds or offering share certificates to the investors. Furthermore, an LLC can apply for bank loans and benefit from lower interest rates compared to other types of businesses in Malaysia.

More details on the limited liability company in Malaysia are available in the following video:

The registration of a company limited by shares in Malaysia is done in accordance with the stipulations prescribed by the Companies Act. The company’s trading name should include the words “Sendirian Berhad” in the case of a private company, while the public company should include “Berhad” in its trading name. Besides these requirements, the company limited by shares must also include the following:

- according to Section 14 of the Companies Act, the company must have a minimum of two shareholders;

- it is also necessary to appoint a minimum of two directors, as required under Section 122 of the Act;

- it is required to appoint a company secretary, who can be represented by an individual licensed by the Companies Commission of Malaysia;

- company’s secretary can also be represented by a member of a professional body prescribed by the Minister of Domestic Trade Cooperative and Consumerism.

Partners of limited liability company in Malaysia needs to sign the incorporation documents for such a structure. They also must be present at the time the registration is made and prepare a supporting letter for the selected type of business. In case you would like to open a limited company in Australia, we can put you in contact with our partners.

Although Malaysian legislation allows foreigners to be the shareholders of a company set up here, the directors and the company secretary should have their main residence in Malaysia; our team of company formation agents can offer more details on the residency requirements imposed on the company’s representatives.

When registering a limited liability company in Malaysia, the investors should prepare information on matters such as the company’s proposed name, the types of business activities developed by the company, the location where the company’s registered office is situated (a compulsory requirement during the procedure of opening a company in Malaysia) and also declarations signed by the company’s directors (they have to provide evidence on the fact that they are not bankrupt in this country, nor outside of it, and they have not been convicted of any criminal office).

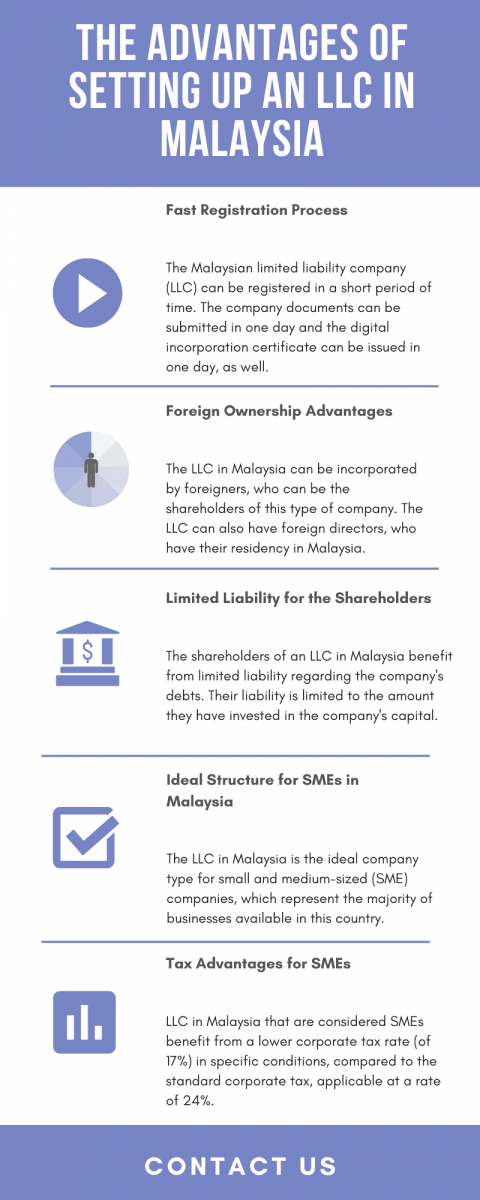

Which are the main advantages of a Malaysian private company limited by shares?

One of the most representative advantages of a business established as a private company limited by shares is the liability protection available for the shareholders, who are not fully liable for the company’s debts. At the same time, this type of company provides a simple procedure related to the transfer of shares, in a situation in which the company will have new shareholders.

The statutory documents of the company should stipulate that the maximum number of members is limited to 50; at the same time, the bylaws should contain restrictions referring to the public’s participation in the company’s shares. It is important to know that a private company limited by shares can also be registered with a single director.

Foreigners who want to start a business in Malaysia can do so as soon as they choose their preferred structure. The paperwork and procedures can be handled by one of our company formation agents who have experience in this matter. We mention that the establishment process does not last more than 10 days, and a single shareholder is enough to open a limited liability company. You can also turn your attention to buying a shelf company for a faster start of activities.

What are the main post-incorporation aspects that should be handled by investors in Malaysia?

After the main registration procedures have been completed, the investors should also handle a set of aspects in order to be able to open the respective company. In this sense, it will be necessary to establish a business bank account and register with relevant authorities. Some of the most important matters are the following:

- register for the employee’s retirement fund, social security, and human development and training;

- establish the company’s Annual General Meeting (AGM), which is completed in accordance with the type of company chosen for registration (private or public);

- lodgment of the annual return, which has to be sent no later than 30 days from the anniversary of the incorporation date;

- filing tax returns – the company is required to register with the Inland Revenue Board once the business has become operational.

The registration certificate of an LLC in Malaysia is issued in about an hour if all the documents are correct and the payments are done. It is forbidden to run a business in Malaysia without incorporating first, a matter where our local specialists can help.

Normally, the registration of an LLC in Malaysia should take around 14 days, depending in the formalities, type of documents, accuracy, and if support is provided by a specialist in this endeavor.

What are the main taxes for companies in Malaysia?

All companies registered in Malaysia, including the limited liability company, are required to pay a set of corporate taxes. As long as the company is incorporated in Malaysia, and thus, it has its residency registered in this country, it will become liable for taxation, following the tax principles available here. The regulation is also applicable to sub-divisions of foreign companies, which must pay taxes in accordance with their commercial activities developed on the Malaysian territory.

The taxable income of a company in Malaysia refers to income such as the income obtained from commercial activities, profits, dividends, royalties, interest, or rent. However, the taxation of the company’s dividends can be avoided under specific circumstances, which can be presented by our team of consultants in company formation in Malaysia.

The standard corporate tax rate in Malaysia is 24%, but a lower rate – 17% – is applicable to small and medium-sized companies, provided that certain conditions are met. Companies can also be liable for the payment of capital duty, payroll tax, real estate tax, or social security, to name just a few.

We suggest the services of our accountants in Malaysia if you have planned a business in this country. Thus, you will ensure a series of procedures necessary for the smooth running of a business. Among them, we mention payroll services, bookkeeping, preparation and submission of annual financial statements, audits, investment consultancy, support for tax registration, debt monitoring, and more. On request, you can also benefit from the administration of human resources, but contact us to find out more.

Taxes paid by limited liability companies in Malaysia

All companies operating in Malaysia must register for tax purposes. If a company’s management and control are in Malaysia, the company is considered a tax resident of this country. Chargeable income from Malaysian LLPs is taxed at a 24% rate generally. Any LLP with a capital contribution of RM 2.5 million or less enjoys a lower tax rate of 19%. The entire profit of this LLP is exempt from taxation. Businessmen interested in receiving more details about taxes paid by LLPs can address our team of company incorporation agents in Malaysia.

The limited liability partnership, a type of company that reunites the characteristics of a private limited company with the ones of a partnership, is seen as a separate legal entity that is suitable for small businesses and professionals who want to work in their own name. It must have, however, two partners who must obtain a certificate of registration for this entity from the Companies Commission of Malaysia.

Partners or clients can obtain from this institution information on any LLP registered by it, by requesting current data on the LLP (an LLP profile) or the LLP’s registration certificate, which, in 2024, can be issued for a fee of RM20 each.

What is the duration of the registration process in Malaysia in 2024?

The duration of the procedure of company registration in Malaysia can vary based on the legal entity of the company; for example, a sole trader can be registered much faster, as there are only a few incorporation requirements, while more complex structures will have to go through a larger number of procedures. In the case of a limited liability company in Malaysia, the following should be expected:

| Proposing a corporate name for the company | The procedure can be completed in approximately 24 hours |

| Gathering the documents necessary for the registration | It can last approximately 2-3 days |

| Submitting the registration forms | This can also last approximately 1 day |

| The issuance of the digital incorporation certificate | It can be issued in 1 day |

The company in Malaysia must also have a company registration number and the duration of the issuance of the registration number can increase by up to 11 days. During the procedure of company formation in Malaysia, the company’s shareholders and directors are required to sign a set of documents, and this procedure can also last up to one day.

Private limited liability companies in Malaysia can enjoy other advantages too, such as affordable rental costs, because premises expenses in Malaysia are quite high.

In the case of private LLCs in Malaysia, the financial distribution is much more suitable. On the other hand, the share and ownership transfer procedures are reasonably less complicated in this case.

What are the main company types used in Malaysia (by size)?

As we mentioned above, the limited liability company is the most selected legal entity for company formation in Malaysia, as this is the most suitable business form for small and medium-sized enterprises (SMEs). SMEs represent the largest category of companies operating in this country, accounting for 98.5% of all the businesses registered in Malaysia. SMEs in Malaysia are divided as follows:

- SMEs in Malaysia operating as small companies are around 229,000 registered businesses, according to data for 2022;

- the largest share of Malaysian SMEs is available in the case of microenterprises, which account for 76.5% of all SMEs;

- the majority of Malaysian SMEs were incorporated in the services sector (89.2% of all companies);

- the other top economic sectors in which SMEs activate are the manufacturing industry (5.3%) and the construction sector (4.3%).

Persons who need further information on the company limited by shares (or limited liability company) or who want to open another type of company in Malaysia in 2024 can contact our team of representatives in company registration in Malaysia for more details. Our representatives can assist with advice on all the aspects concerning the registration of a business in the local market.