Entrepreneurs who want to open a company in Malaysia should also open a separate bank account in the name of the company. It is important to know that foreigners are allowed to open a bank account in Malaysia if they provide several documents, which can vary according to the internal policies followed by the financial institution. Our agents specialized in company formation in Malaysia can assist foreign investors in completing this action, which is due after the incorporation of the business. Talk to us about how to open a bank account online in Malaysia.

| Quick Facts | |

|---|---|

| Who can open a bank account in Malaysia? | Both residents and non-residents in Malaysia, whether natural persons or entities |

|

Formalities to open a bank account in Malaysia |

– work, residence permit, a valid ID, proof of employment for natural persons, – company documents for legal entities |

|

Required documents |

– Articles of Association and Certificate of Incorporation for companies, – a valid passport and proof of domicile in the case of natural persons |

| Types of bank accounts |

– saving accounts, – deposit accounts, – debit and credit accounts |

| Debit or credit card issued with a bank account |

Yes |

| Cash deposit to open a bank account in Malaysia |

Some banks might require a small deposit |

| Fees to open a bank account |

Depending on the chosen bank |

| Banking services offered (YES/NO) |

Yes |

| Possibility to open a bank account online (YES/NO) |

Yes |

| Possibility to pay online the utility bills (YES/NO) | Yes |

| Overseas money transfers accepted (YES/NO) |

Yes |

| Formalities for student bank account |

– letter of approval from the University, – specific bank forms, – residence permit, – proof of domicile |

| Loans option available (YES/NO) |

Yes |

| Offshore bank accounts |

Under certain conditions, depending on the business structure. |

| We provide support for opening a bank account in Malaysia (YES/NO) | Yes |

Table of Contents

The banking system in Malaysia

When opening a corporate bank account in Malaysia as a foreigner, investors should be aware of the fact that banks can apply a different set of requirements; moreover, branches of the same legal entity can apply different practices. Still, the differences are rather small, but before opening a bank account it is advisable to obtain information on the requirements of the specific banks that interest the entrepreneur.

According to local legislation, foreigners must have a Malaysian work permit to be able to open a bank account; our company formation specialists can offer more details on this subject.

Non-residents in Malaysia can open personal savings or personal current accounts in this country. They also can choose a combination between these two, depending on the financial needs of the customers.

Below, businessmen can find supplementary information related to the bank account in Malaysia:

Required documents to open a bank account online in Malaysia in 2024

Foreign businessmen who set up companies can open a bank account in Malaysia if they provide the following set of documents, which are compulsory for most banks:

- complete a bank account application form;

- recommendation of an introducer;

- company’s stamp;

- copies of the passports of the company’s directors.

The directors will also have to provide several documents of the company which has to be presented in the form of certified true copies provided by the company’s secretary.

All banks in Malaysia require the following documents:

- resolution from the Board of Directors for the opening of the bank account;

- list of directors;

- registered office address;

- memorandum;

- articles of association;

- certificate of incorporation;

- a proof of the fact the company’s directors are not bankrupt.

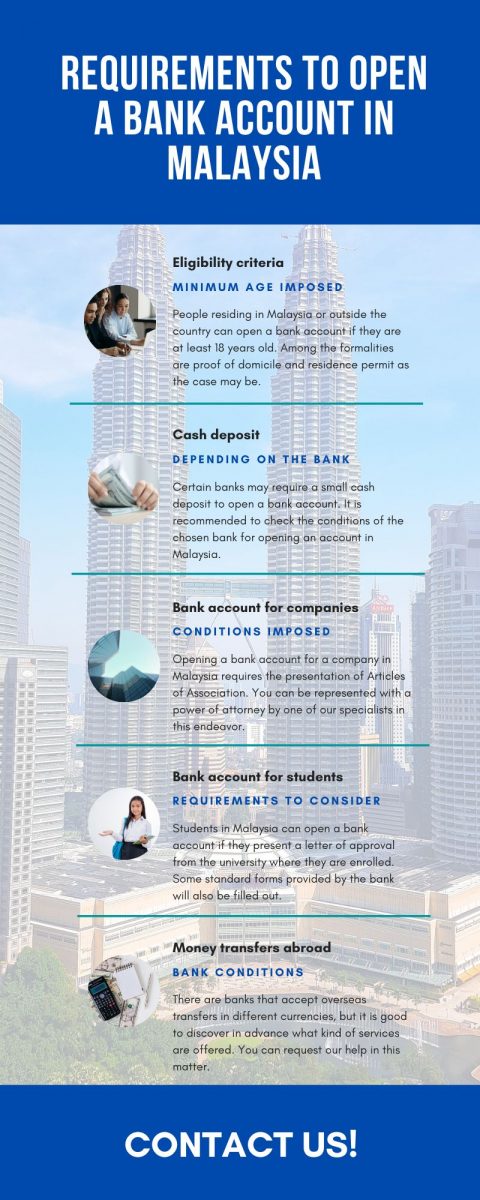

Companies that are incorporated in Malaysia, like those that are registered elsewhere, are eligible for setting up a corporate bank account, but in 2024, as a foreign company, you will need to have an official business address in Malaysia for your company to be able to open a bank account, as, in the last years, Malaysian banks have imposed new measures. However, this rule may not apply to all banks and prior you should compare the requirements of local financial institutions. Contact us if you want to open a bank account online in Malaysia and also check the following infographic:

How to open a bank account online in Malaysia

There are banks in Malaysia that allow you to open a bank account online, in just a few simple steps. Foreigners interested in how to open a bank account online in Malaysia must first authenticate using a standard form and personal email address. You can then use the respective bank’s mobile application to choose the desired product. But to be able to close the entire registration process, you need to scan the identity document online.

Normally, once the respective request to open a bank account is accepted, the card attached to the account is also issued, to be sent to the applicant’s home address. Certain banks also require the physical presence of the person who opened the bank account, for some signatures, but most of these financial institutions have implemented very simple online formalities.

Therefore, if you want to open a bank account in Malaysia as a foreigner, feel free to talk to our local advisors for guidance. We can speed up the process, so don’t hesitate to collaborate with us.

If you want to set up a business in Malaysia, we recommend specialized help from our local company formation agents. With their help, you will have the guarantee that all the documents are drawn up correctly and that there will be no errors in this regard. Also, where appropriate, we will help you with shelf company acquisition. Redomicilization of companies in Malaysia is also allowed, for which it is necessary to comply with certain formalities.

There are around 27 commercial banks in Malaysia, among which 19 are licensed foreign financial institutions. Also, there are 11 investment banks and other 18 Islamic banks to choose from when deciding on opening an account.

Do I need a small deposit to open a bank account in Malaysia?

If you want to open a bank account in Malaysia as a foreigner, you must consider the formalities imposed by the chosen financial institution. If some of these do not impose any rule regarding a small deposit to open such an account, others have already implemented this rule. Normally, the deposited amounts are quite small and remain in your account, but it is good to find out if a deposit is needed to open a bank account in Malaysia.

Many banks in Malaysia require a minimum deposit to open an account. Such a deposit can range between RM 500 and RM 1,000, depending on bank policies and the type of bank account. It may also be necessary to maintain a minimum balance to reduce bank fees.

Are there eligibility criteria to open a bank account online in Malaysia?

Yes, only people over 18 years old and with residency in Malaysia can open such a bank account. This is valid both in the bank’s physical representatives and online where there is an option to open a bank account in Malaysia.

Even if it is possible to open an online bank account in Malaysia, some banks require physical presence to sign documents and verify them. We can represent you with power of attorney if you want to open such a bank account and you cannot travel to Malaysia.

You can rely on the services provided by one of our accountants in Malaysia if you want to develop a business in this country. We mention that in addition to payroll, audits, and bookkeeping, we can also take care of the preparation of annual financial statements, as well as the collaboration with the relevant institutions in the financial field. Risk assessment and evaluation might interest you because it is important to know in advance the financial risks to which your company may be exposed.

Opening a bank account in Malaysia from abroad

If you still have to wait until you relocate to Malaysia, but you need to open a bank account, you should know that not all banks accept this type of service. That’s why you should pay attention to those that allow you to open an online bank account in Malaysia from your country of origin or any other country.

You should also know that even in this permissive situation, you still have to go to the bank when you enter or relocate to Malaysia to present various documents, including the visa and residence permit. We remind you that you can benefit from the support of our local agents if you want to open a bank account in Malaysia as a foreigner.

Most of the banks in Malaysia have a large number of branches, ranging between 100 and 170 in the entire country. Many of them impose maintenance fees, alongside the ones for international transfers. Your bank officer can tell you more about the services provided.

In Malaysia, you can open a joint bank account with the spouse. In this case, the banks can request other documents as well as proof of an existing bank account with the help of which to check the bank history of spouses willing to open a joint bank account in Malaysia.

Documents required for opening a bank account as a foreigner in Malaysia

Besides the option to open a bank account for the company, foreign nationals working or studying in Malaysia have the opportunity to do so, with the required documents. In the case of workers, the employment contract, work permit, and employer letter certifying the activities you have are needed. A student from abroad can open a bank account in Malaysia as a foreigner if he/she presents a letter of acceptance from a college or other educational institution in Malaysia.

As for foreign entrepreneurs who want to open a business in Malaysia, the following information may be useful:

- Malaysia registered around USD 187 billion in terms of total FDI stock in 2021.

- Most foreign investments were absorbed by sectors such as manufacturing and services in 2020.

- FDI inflows were approximately USD 3 billion in Malaysia, according to data for 2020.

If you need further details on the procedure for opening a bank account in 2024, please contact our company formation specialists in Malaysia for assistance on the documents required by a specific bank that you might be interested in collaborating with. If you want to open a bank account in other countries, such as Lithuania, we can put you in touch with our local partners.